How to set up sales tax in QuickBooks Desktop - QuickBooks. If we receive a coding notice from HMRC, well change your tax code immediately. Keep a copy of this form for your personal records. If you do not know this you can find it in your myIR Secure Online Services account or on letters or statements from us.

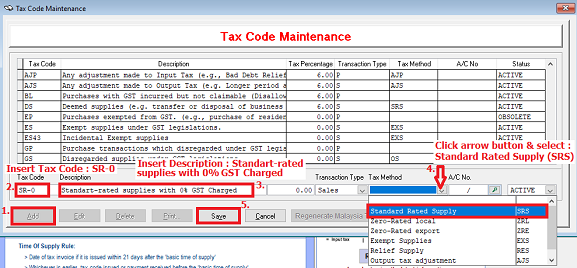

Use a separate form for each employer and use only one tax code on this form. On the Lists menu, choose Sales Tax Code List.

HMRC will adjust your tax code so you pay the right amount of tax across the year. Theyll write to you or you when your tax code has been updated. Key Portfolio We allocate your tax code on instruction from HMRC.

Tax codes: Updating your tax code - After your tax code changes. Start getting money from another source, such as NZ Superannuation.

How do I change my tax code? - Key Portfolio

Changing your tax code - NZ Government You might need to adjust your tax code on all your sources of income so that you pay the right amount of tax if you: stop working. From the Sales Tax Code drop-down, choose New. Please print, sign the form and give it to your employer.

How do I change my tax code? Changing your tax code for NZ Super and Veteranaposs Pension. Your next payslip should show: your new tax code.

They will also tell your employer or pension provider that your tax code has changed.

How to set up sales tax in QuickBooks Desktop - QuickBooks

On the New Sales tax Code window, enter the Sales Tax Code (maximum of characters that youll recognize on a form such as an invoice then add the corresponding description as a reminder of what the code stands for). If you believe that your tax code doesnt best suit your circumstances, you should contact HMRC as soon as possible so they can advise. 1 20The UPS Store, Inc., the worlds largest franchisor of retail shipping, postal, print and business service centers, has been ranked again as one of the top franchise brands, according to Entrepreneur Magazines 20Franchise 500. Red Flags That Could Trigger a Tax Audit Taxes US News Jan 2 20An IRS audit takes place when the Internal Revenue Service chooses to review a taxpayeraposs accounts to verify that tax laws are being followed.

ATM Near Me - Find ATMs Nearby My Location Use ATM Locator to find nearby Mastercard ATMs. And rolls of microfilm 4RECORDS OF SELECT AND SPECIAL. Bonus Depreciation - Drake Software When you enter a qualified asset on the 45screen, the software automatically calculates bonus depreciation based on the date placed in service, metho life, and other IRS guidelines.

Cambridge Dictionary Plus My profile Plus help Log out Dictionary. E File Extension - What is it? FAFSA Available Three Months Earlier In the past the FAFSA form became available on January of the calendar year for the academic year starting in the fall of that year extending into the next calendar year for the second semester of an academic year. Find ATM Locations Locator Search Cardtronics Help cardholders find your banking service locations quickly and easily with LocatorSearch, a comprehensive suite of on-demand location search software for web and mobile.

For tax year 202 the foreign earned income exclusion is 106up from 10900. How To Withdraw Money From ATM Machine - Step by Step for. IR - Experience Management Solutions IR Partners We work with the best organizations to help more customers solve their experience management issues.

IRS Can Help Internal Revenue Service IRS Tax Tip 2016-1 February 2016. If you want the exact branch, then just dial the customer care number of your bank, and let them know the ATM I they will tell you the name of the branch. Income Tax Slabs: Here are the latest income tax slabs and. Insert completed data sheet and all relevant tax documents into the folder and directly hand to a Jackson Hewitt Tax Pro or other office personnel, who will securely store your documents.

It will fetch all the recods for your location. Just those two figures are sufficient to get you most of the way to a good estimate of how big your 20tax refund will be. Just used the online version (Taxact Online Plus) to file.

Loans are offered in amounts of 50 75 12or 3000. Philippines - Individual - Taxes on personal income For resident and non-resident aliens engaged in trade or business in the Philippines, the maximum rate on income subject to final tax (usually passive investment income) is 20. See also: borrow, living, on, time beg, borrow, or steal To acquire or accomplish something by any means. Tax Refund Calculator Calculate your tax refund TaxSlayer Another scenario that could create a refund is if you receive a refundable tax credit that is larger than the amount you owe. Tax levy - Oct 1 20Many people confuse tax levies with tax liens.

Taxpayers who report an income of zero have a in chance of an audit. That means you have no choice but make significant cuts in defense. The Go Big Refund Advance is a 3 APR loan.

There are between 5MPs on each committee.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.