Grover Norquist Americans for Tax Reform Indexing capital gains taxes to inflation will build on the success of the Tax Cuts and Jobs Act in growing the economy and increasing the wealth of American middle-class families. Plan B shoul by definition, be considered a violation of said pledge which has defined Republican ideology and policy since George H.W. The Man Behind The GOPaposs No-Tax Pledge : NPR Jul 1 20The Man Behind The GOPaposs No-Tax Pledge One person with outsized influence in the debt-ceiling debate is not at the negotiating table. Restore American Prosperity With 2nd Commandment of.

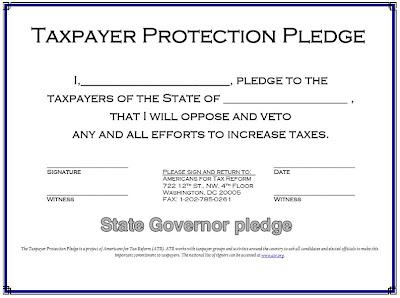

But Speaker Boehner deserves a lot of credit for so clearly exposing Grover Norquists American Taxpayer Pledge as an out-and-out sham. About the Taxpayer Protection Pledge Americans for Tax. Current List of Taxpayer Protection Pledge Signers for the. The Taxpayer Protection Pledge stands as a barrier against tax hikes and makes continued pro-growth tax reform possible.

The Incredible Life Of Grover Norquist, The Man Behind The GOPaposs Famous Tax Pledge.

In 198 Grover Norquist, founder of Americans for Tax Reform, encouraged by President Reagan, formulated a. Anti-tax advocate Grover Norquist wants to hold Republicans to. Bush was abandoned by the far right for violating his no. ATR President Grover Norquist applauded President Trumps. days ago Capitalismaposs Second Commandment codifies Grover Norquistaposs famous Taxpayer Protection Pledge: There shall be no reduction or elimination of income tax deductions and credits unless matched dollar for dollar by further reducing tax rates. Plan B Proves Grover Norquists Pledge Is A Sham.

While ATR has the role of promoting and monitoring the Pledge. Grover Norquist On Taxes, Socialism And The Demonization. We are ecstatic about Kistners decision to sign the Taxpayer Protection Pledge to the taxpayers of Minnesota, said Grover Norquist, President of Americans for Tax Reform.

The idea of the Pledge is simple enough: Make them put their no-new-taxes rhetoric in writing.

Grover Norquist Americans for Tax Reform

.jpg)

Apr 2 20Grover Norquist is President of Americans for Tax Reform (ATR a taxpayer organization that opposes all tax increases as a matter of principle and has been leading campaigns for tax). Who Is Grover Norquist And What Is His Pledge? The pledge has been signed by all but of the incoming Republican members of the House of Representatives. By signing the Taxpayer Protection Pledge, candidates and incumbents make a written commitment to oppose any and all tax increases.

Grover Norquist - Nov 2 20Cenk Uygur (mcenkuygur) host of The Young Turks discusses several well known Republicans back pedaling on their tax pledge to Grover Norquist.

A look through the records shows that top earners in the eight years of Eisenhowers presidency paid a top income tax rate of percent. Both played on stereotypes which I Loved they made us look into ourselves a little. Combined rates mentioned above are the of Illinois state rate (the county rate (the Chicago tax rate (to and in some case, special rate (1).

File easily and securely from your smart or computer. Filers with dependents who do not qualify for the child tax credit will. Find local government offices in your state, county, and city. Get Transcript by Mail Use of this system constitutes consent to monitoring, interception, recording, reading, copying or capturing by authorized personnel of all activities. Get help choosing a tax professional to file your taxes.

H R Block Coupon Code For Returning Customers - Home. How to Calculate Your Effective Tax Rate Oct 1 20Your effective tax rate is the average rate you pay on all your taxable income.

Identity Thief - Movie Review - Reviews Age Ratings Feb 0 20What parents need to know. If you get the severe disability premium, or you got it in the past month and remain eligible, you can still make a new child tax credit claim. In 20the corporate income tax rate will be (2018: 20) on the first 200of taxable profits (2018: 20000) and (2018: 25) for taxable profits exceeding 20000. Include your total income, filing status, deductions, and credits.

It also provides the option to view statements for the past months in either PDF or Excel format. Nov 2 20The Tax Cuts and Jobs Act came into force when it was signed by President Trump. Nov 3 20The child credit is a credit that can reduce your Federal tax bill by up to 0for every qualifying child. ONET OnLine ONET OnLine has detailed descriptions of the world of work for use by job seekers, workforce development and HR professionals, students, researchers, and more.

States, including specific career, employment, education and economic information. The Garden State has a progressive income tax system. The Home Mortgage Interest Tax Deduction is an itemized deduction you can claim on your tax return for home mortgage interest you paid during a Tax Year. The deduction does come with one glaring stipulation: Generally, taxable income must be below 155if youre single and 310if youre married and file jointly. The nonpartisan Tax Policy Center projected the tax law would reduce individual income taxes by about 260.

The tax reform changes went into effect on Jan. To be deductible, your expenses must be for education that (1) maintains or improves your job skills or (2) a law requires to keep your status or occupation. Transcript or Copy of Form W-Internal Revenue Service Jan 0 20Yes, but an actual copy of your Form W-is only available if you submitted it with a paper tax return: Transcript You can get a wage and income transcript, containing the Federal tax.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.