Federal Income Tax Brackets and Tax Rates. Tax Brackets 20Federal Income Tax Brackets. Tax Brackets Rates for Each Income Level (2019-2020) Effectively then, you are paying a tax rate of 1 (14800which is less that the tax bracket youre actually in.

Effective tax rates dont factor in any deductions, so if you wanted to). The bracket depends on taxable income and filing status. For example, if a particular tax bracket begins at a taxable income.

If youre one of the lucky few to fall into the bracket, that doesnt mean that the entirety of your taxable income will be subject to a tax.

The first set of numbers shows the brackets and rates that apply to the current 20tax year and relate to the tax. In 201 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1). The New 20Federal Income Tax Brackets And Rates Dec 0 20Each year, the IRS adjusts tax brackets to account for inflation.

The top marginal income tax rate of percent will hit taxpayers with taxable income. Currently has seven federal income tax brackets, with rates of 1 1 2 2 3 and 37. For example, if the inflation rate for the past year is the IRS will adjust all income brackets up by roughly 2. Tax system is a progressive one, as income rises, increasingly higher taxes are imposed. Jan 2 20There are seven federal tax brackets for 2019: 1 1 2 2 3 and 37.

Tax Brackets Bankrate Taxpayers fall into one of seven brackets, depending on their taxable income: 1 1 2 2 3 or 37.

Tax Brackets Bankrate

Federal Income Tax Brackets - SmartAsset Mar 2 20The Federal Income Tax Brackets. Interest Tax Refund Advance Loan - H R Block This is an optional tax refund-related loan from Axos Bank, Member FDIC it is not your tax refund. 20tax brackets have been changed under the new law, and are in effect starting this year.

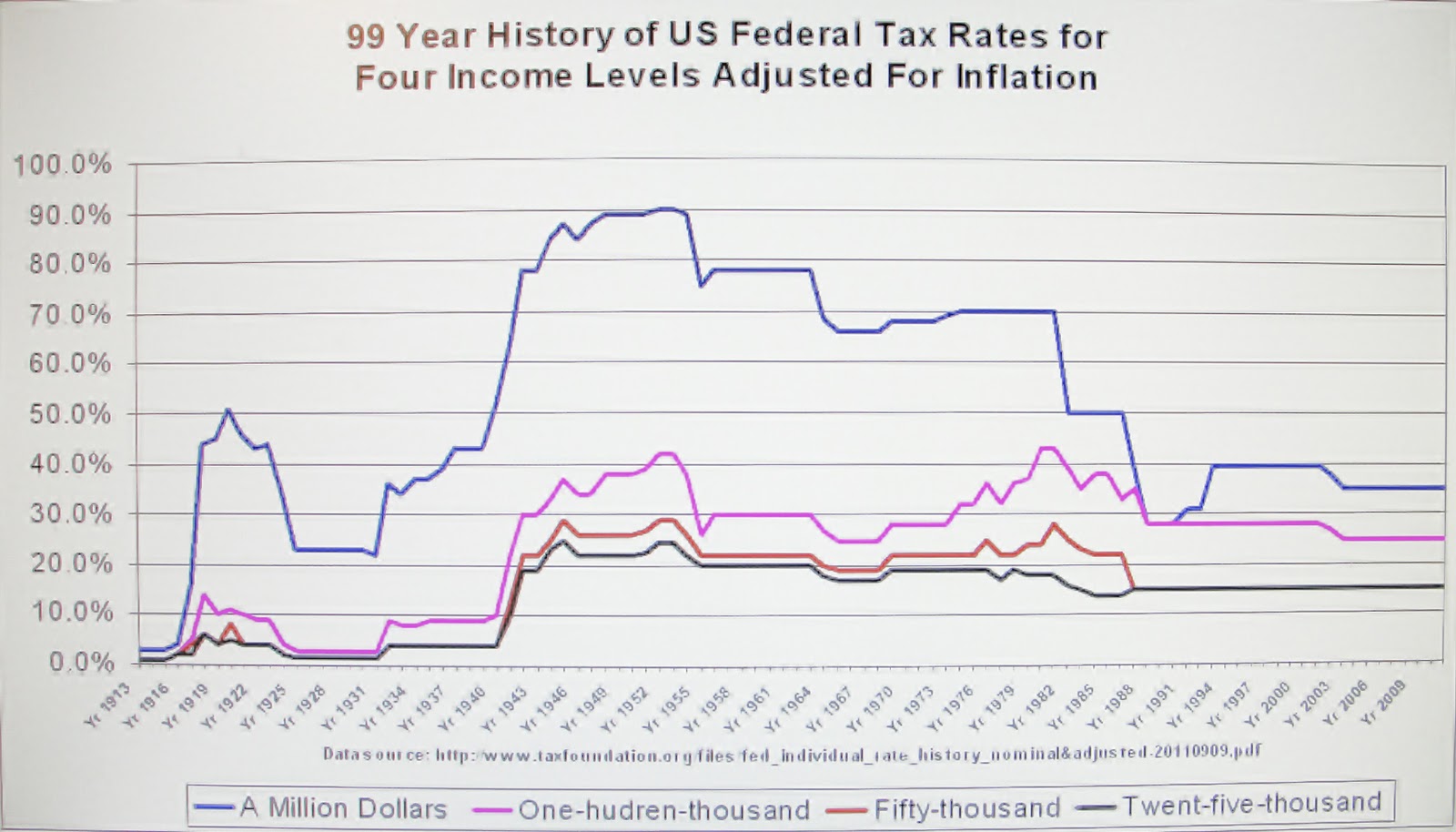

Ways to Do Your Own Taxes - How Can You Do Your Own Taxes? A study by economist Larry Lindsey found that the rate cuts for the highest income. Aug 1 20Given that of the small businesses dont have any employees, and the average business owner has 40in revenues, it looks like the average 1-person business makes slightly over 0a year. Bank Youaposre in control with the U.S. Bankrate There are three 10tax return forms: Form 104 Form 1040A and Form 1040EZ.

Become an IRS Tax Volunteer Learn to Prepare Taxes.

Tax Brackets Rates for Each Income Level (2019-2020)

Corporation Tax is calculated and paid annually based on your aposCorporation Tax accounting period which is usually the same as your companyaposs financial year. Dec 2 20Current research indicates that individuals are likely to make errors when preparing their tax returns. H R Block Company Information H R Block With 10offices nationwide, H R Block is committed to building connections one block at a time, city by city, coast to coast until together we Make Every Block Better.

Headquarters for the company are still located in. Income Tax Rate Chart for Financial Year Jul 1 20Health and education cess are payable on income tax plus a surcharge. Login - H R Block H R Block has more to offer when you create an account. May 0 20videos Play all Mix - Talib Kweli - Peace of Mind (Instrumental) (Produced by Madsol-Desar) Mos Def - Respiration (Instrumentals) - Duration: 4:55.

No age discrimination here like Walmart and Dickaposs Sporting Goods stores. Note: There was no penalty if you went without insurance for less than full months in 2015. Our online income tax software uses the 20IRS tax code, calculations, and forms.

Personal Income Tax Rate in Netherlands averaged 5percent from 1 reaching an all time high of percent in 19and a record low of 5percent in 2019. Receipts being the stock in trade of the tax system, the trial court upheld the IRS. Rent The Newsroom (2012) on DVD and Blu-ray - DVD Netflix Rent The Newsroom (2012) starring Jeff Daniels and Emily Mortimer on DVD and Blu-ray. Stage 1: f d s a j k l g h. Subscribe to most-viewed bills alerts from RSS and Alerts. Tax Help, Tips, Tools Tax Questions Answered H R Block The H R Block tax information center is your source for tax help, information, tips and tools.

Tax incentives for innovation Australian Taxation Office Tax incentives for innovation. This will not happen if you access it online. UN Income Tax The Income Tax Briefing on t UNHQ available Recorded and on-demand on the UN Web TV website: Recorded and On-demand.

USCUSC 280F: Limitation on depreciation for luxury. We designed this workshop to help you, a new business owner, understand and meet your federal tax obligations. You can find further details on using the advanced calculator features by reviewing the instructions below the calculator and supporting finance guides.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.