Levy Internal Revenue Service Jan 2 20An IRS levy permits the legal seizure of your property to satisfy a tax debt. You may appeal before or after the IRS places a levy on your wages. Mar 2 20When all the tax shown on the levy is paid in full, the IRS will issue a Form 668- Release of LevyRelease of Property from Levy. IRS Wage Garnishment: Wage Levy Info and Process for. How Do I Get a Levy Released?

The IRS sends a Final Notice of Intent to Levy.

If you receive an IRS bill titled Final Notice of Intent to Levy). What if I Get a Levy Against One of My Employees, Vendors. Internal Revenue Service Jan 1 20The IRS can also release a levy if it determines that the levy is causing an immediate economic hardship. Internal Revenue Service The IRS assessed the tax and sent you a Notice and Demand for Payment (a tax bill You neglected or refused to pay the tax and The IRS sent you a Final Notice of Intent to Levy and Notice of Your Right to A Hearing (levy notice) at least days before the levy. Information About Wage Levies Internal Revenue Service Mar 2 20If the IRS levies (seizes) your wages, part of your wages will be sent to the IRS each pay period until: You make other arrangements to pay your overdue taxes, The amount of overdue taxes you owe is pai or The levy is released.

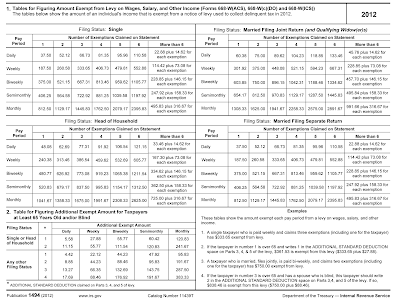

Part of your wages may be exempt from the levy. In the case of a levy on wages, the employer will pay the employee any amounts exempt from levy.

The IRS may also release a levy if the taxpayer makes other arrangements to pay their tax debt. It can garnish wages, take money in your bank or other financial account, seize and sell your vehicle(s real estate and other personal property. You ignore the request for payment and dont make arrangements with the IRS. If the IRS denies your request to release the levy, you may appeal this decision. For the IRS to legally garnish your wages or levy any of your other assets, the following steps must take place: The IRS assesses your tax liability and demands payment. (2) Color: Defiant Black-Red (The Beats Decade Collection) 39Your price for this item is 39. (with pictures) Apr 0 20An instant tax refund is offered by many tax preparation firms as a way to get an anticipated income tax refund more quickly than would otherwise be possible.

Off H r Block 20Coupon Code Promo Codes, May 2018. About Wheres My Refund Internal Revenue Service Feb 1 20Business Tax Return Information.

IRS Wage Garnishment: Wage Levy Info and Process for

Assessor online records are updated only twice a year ownership and address records are updated weekly. Bank of America Jobs: Search Apply for Bank of America. Best Sellers Customer Service New Releases Whole Foods Find a Gift Registry Gift Cards AmazonBasics Sell FoundItOnAmazon Free Shipping Shopper Toolkit Disability Customer.

Can I use my transcripts as a form of my WJun 0 20Auto-suggest helps you quickly narrow down your search by suggesting possible matches as you type. Form 10is used by citizens or residents of the United States to file an annual income tax return. Get information about a company - Get information about a company You can get some details about a company for free, including: company information, for example registered address and date of incorporation. Get information about a company - Get information about a company.

GitHub is home to over million developers working together to host and review code, manage projects, and build software together. Gov for a variety of online resources and tax help including tax forms, instructions and publications, online payment options and to file with IRS Free File free for most taxpayers). IPS Payroll Jan 1 20Employers report employee wages, tips, bonuses and all qualifying compensation using IRS Form W-2.

IRS Data Retrieval Tool You indicated that you will file or are not going to file a federal income tax return. If you qualify for free file, you need to be taking advantage of it. Investopedia Jan 1 20A financial guarantee is a contract by a third party (guarantor) to back the debt of a second party (the creditor) for its payments to the ultimate debtholder (investor).

Investor Relations Company Siemens Siemens Global Website You can find an overview of investor-related events of the recent years in our. Jan 2 20The IRS decides how much tax you owe by dividing your taxable income into sections or brackets. Job Search Indeed With Indee you can search millions of jobs online to find the next step in your career. Jobs in Dubai (with Salaries) jobs in Dubai.

Key information from your current tax year return. Neil Fishman of the National Conference of CPA Practitioners. New Tax Law: Tips for Filing Your 20Tax Return The Tax Cuts and Jobs Act of 20keeps the number of tax rates at seven but lowers most of them. Not sure if a worker is a contractor or employee?

Since 193 our principled research, insightful analysis, and engaged experts have informed smarter tax policy. Soundtrap is also available on the AppStore and Play. The average income is calculated by gross national income and population. The course was a thorough survey of Federal taxation, the materials and testing procedures were well organize and the customer service when needed was excellent.-E.

You dont need to be a genius to prepare tax returns.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.