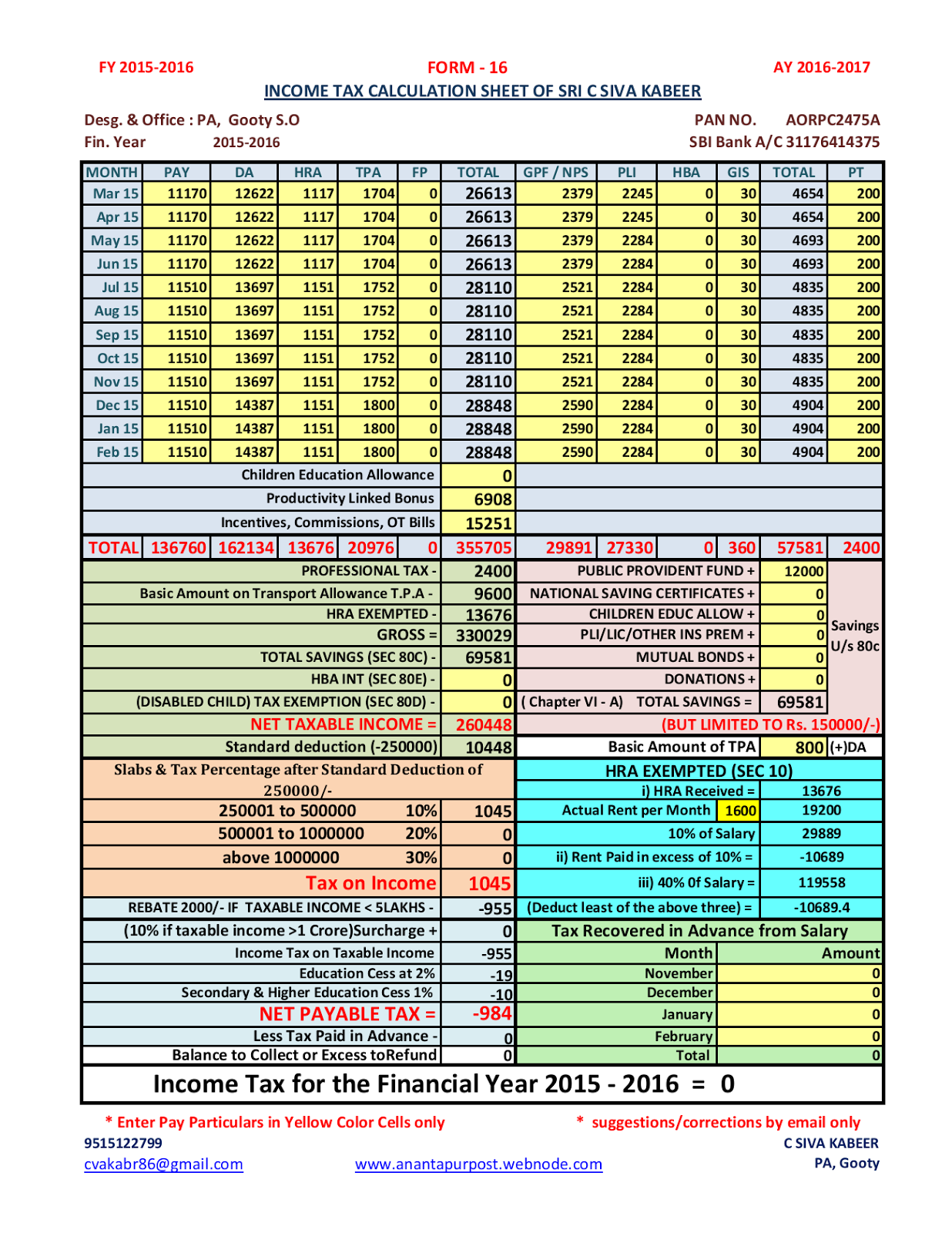

This excel-based Income tax calculator can be used for computing income tax on income from salary, pension, gifts, fixed deposit and bank interest, house rent and capital gains (short and long term gains). Apr 0 20Income Tax to be calculate automatic. Supposing you have got the tax table in the Range A5:Cas below screenshot shown, and your income is placed in the Cell C1. Income Tax Calculator for the Financial Year 2019-for Salaried Individuals in India in Excel.

You can set your investment Declaration Proofs Planing as per requirement. Tax Withholding Estimator Internal Revenue Service Feb 0 20This Tax Withholding Estimator works for most taxpayers. 2019-in Excel - Salary, auto calculation of tax on the basis of age of employee.

Income Tax Calculator for FY 2019-AY Excel. Iaposm pleased to share the attached IT calc FY 2018-on salaries it includes NSC vii issue interest calc, rent receipt form and computation sheet. People with more complex tax situations should use the instructions in Publication 50 Tax Withholding and Estimated Tax.

This sheet will calculate House rent allowance ( HRA Rent Exemption calculation ) under section 10(13A) automatic as per your rent paid and selected location. Income Tax Calculator for FY 2019-in Excel for Salaried. Salary Formula Calculate Salary (Calculator, Excel Template) How to Calculate a Minimum Hourly Rate. How to calculate income tax in Excel?

Download Income Tax Calculation Sheet FY 2018-Salaries Persons in Excel format. Tax Planning in the beginning of the Financial Year is always better instead of doing that at. This includes taxpayers who owe alternative minimum tax or certain other taxes, and people with long-term capital gains or qualified dividends. Download Excel based Income Tax Calculator for FY 2019.

To calculate your income tax liabilities as per the new reducing tax rate slab, you need to provide only single input your gross income. Dec 0 20Changes in Income Tax Rules: Rebate under Section 87A changed from Rs 5to Rs 15or 1of income tax (whichever is lower) for individuals with income below Rs Lakhs (from Rs Lakhs) Standard Deduction raised for Salaried Pensioners from Rs 40to Rs 5000.

Tax Withholding Estimator Internal Revenue Service

Income tax calculation sheet for the financial year 2019. Add a Differential column right to the tax table. Standard deduction enhanced for salaried persons from 40to 50in FY 2019-20. Income Tax Calculator FY 2020-(AY 2021-22) Excel Download The second sheet contains a calculator as per the new tax regime with reducing tax rates, where deductions are not allowed.

Now you can calculate your income tax as follows: 1. Jan 3 20Tax calculation sheet for F.Y.2018-A.Y.

Income Tax Calculator for FY 2019-in Excel for Salaried

And when I filed last year (my 2018aposs) I DID request to do a refund Transfer. Approval subject to actual refund amount, identity verification, eligibility criteria, application, underwriting standards, and other terms and conditions. Businesses can get two types of transcripts: a tax return transcript or a tax account transcript. CloudServer VPS - CloudServer VPS is a simple, virtual and elastic Linux instance which offers you near total control.

Consider credit monitoring or identity theft protection to help protect your personal information. Contact Us Coastal Finance Company Have a question? Data, put and ask for legally-binding digital signatures.

Discount valid only for tax prep fees for an original 20personal income tax return prepared in a participating office. Early Tax Refund Anticipation Loans: Who Offers Them and.

Federal Register : Guidance Under Section 108(a. Form 1040-SR, a new form, is available for use by taxpayers age and older. Go to the W-Finder Search Page. IRS Extends Tax Filing Deadline for 20Returns Apr 1 20The Internal Revenue Service has extended the 20federal income tax filing deadline three months to July 1 202 in response to the global coronavirus pandemic sweeping the U.S. Instructions for Form 1040-NR (2019) Internal Revenue.

Kevin Brady, New York, NY - Find Out More BeenVerified Kevin Brady in New York, NY. Mar 3 20Find a VITA or TCE Site Near You. Multiply the amount of tax you owe this year by the answer above. Peace Of Mind Definition of Peace Of Mind by Merriam-Webster Definition of peace of mind : a feeling of being safe or protected Installing a security system in your home will give you greater peace of mind.

Plus, we offer more credits deductions, so you wont have to upgrade and pay extra for your simple tax return. Sales Tax Audits, Part 2: What to do During the Audit After youve provided the necessary records, an auditor will prepare preliminary schedules and sub-schedules these schedules can include expenses, purchases, sales, etc. Select the Services menu in the upper left-hand corner of your Account Summary.

Select Sales tax - file and pay, then select Sales tax web file from the expanded menu. TO WEB FILE CREATE ACCOUNT. Simple Payroll Tax Calculator - Free Paycheck Calculation Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs. Solved: How can i track my federal income tax refund for 20How can i track my federal income tax refund for 20I receive my first check on my 20federal tax returns but I had another 15check that I was waiting on that I never received I cant remember my state or my Federal but I got my big check first and I was waiting on my.

Tax Deadline Changed The deadlines to FILE and PAY federal income taxes are extended to July 1 2020. Tax Plan Calculator by Maxim Lott Will the GOP tax plan lower your taxes or raise them? Tax savings for a single, childless taxpayer under House Republicansapos tax plan.

Taxpayers and tax professionals are encouraged to file electronically. The bank guarantee means a lending institution ensures that the liabilities of a debtor will be met. The lower rates apply to income in the corresponding brackets.

This relief applies to all individual returns, trusts, and corporations.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.