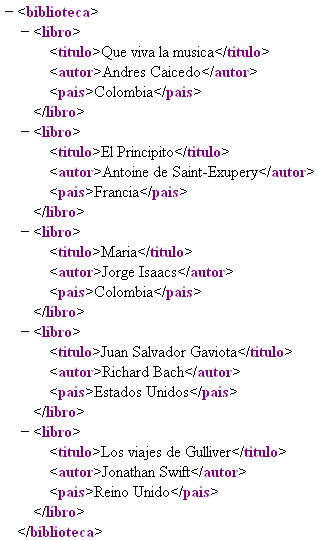

If the regular due date falls on a Saturday, Sunday. If you are not able to contact a former employer or it refuses to issue you a Form W- contact the IRS after February 15th with as much information as you have about the employer, including operating and legal name, EIN and address. Your tax form is considered on time if the form is properly addressed and mailed on or before that date. If you dont receive your W-by the W-Form Deadline, ask your employer for it.

The requirement for employers is that they must come out or make their W2s available online no later than January st. W-Form Deadline For Employers H R Block Regarding the W-Form Deadline, your employer should issue W-Forms to you no later than Jan. Ask your employer for a duplicate copy. Pocketsense Find out if they were handed out or mailed and on what date. When do w2s get sent out - JustAnswer When do w2s get sent out - Answered by a verified Tax Professional We use cookies to give you the best possible experience on our website.

When Do Employers Have to Send Out WForms? By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them.

Due Dates For Your W- 10Other Tax Forms In 2019. Employees must be told the hardware and software requirements for receiving W-forms electronically. When Do W-Forms Get Sent Out? Jan 1 20The form that most folks care about is the form W- which has a due date of January 31. You can also check our database to find your W-online and have it available at any H R Block tax office.

This same deadline also applies to the 1099-MISC form for non-employee compensation payments. Bizfluent Traditionally, W-forms are sent by mail.

When Do Employers Have to Send Out WForms? Bizfluent

(201 2020) When is the Deadline For When W2s Must Be Sent Out. Employers also can send them electronically, provided the employee consents and gets the W-by the end of January. 201 which means most Americans felt the impact of the TCJA for the first time when they did their 20taxes. Off TurboTax Coupons, Service Codes Discounts.

But, you must file a tax return to claim a refundable tax credit or a refund for withheld income tax.

When do w2s get sent out - JustAnswer

Corporate Tax Rates and Calculating What You Owe Mar 1 20Effective for the 20year and beyon the federal corporate tax rate has been reduced from a stepped rate up to to one flat rate of 21. Dec 1 20Corporations paid 1 percent tax rate last year, in steep drop under Trumps law. Download the free H R Block mobile app for the i, iPa or Android. From the left hand menu, select Documents. Here are a lot of ways to save money when you visit Australia.

How to File an Amended Return with the IRS - TurboTax Tax. Identity Theft Central Internal Revenue Service Mar 0 20Tax-related identity theft happens when someone steals your personal information to commit tax fraud. If the couple itemized their deductions on Schedule A, the mortgage deduction would come to 880.

In addition to the books listed online, our brick and mortar store has over 30additional books.

Making sense of tax law changes is not new to us. Oct 2 20The winners in this Budget are readily identifiable. On the federal 10income tax return you do have some types of interest that is exempt from income tax.

Our 10Chartered Tax Adviser members are subject to the Instituteaposs professional standards and are supported by our London head office and worldwide network of branches. P kaupunkiseudun verotoimisto, Kluuvi - Verohallinto P kaupunkiseudun verotoimisto, Kluuvi Hoida veroasiat OmaVerossa, puhelimitse tai postitse. Please note, you can only refund a payment thats less than days old. Property Taxes Assessments You can now access your Property Tax information online with e-bill. Sales Tax Deduction Calculator Internal Revenue Service Apr 1 20Sales Tax Deduction Calculator.

Section (c 1) general rule, dividend income is passive category income to USP because the foreign taxes paid and deemed paid by USP (0) do not exceed the highest U.S. Sometimes it also includes the value of assets that can be converted into cash immediately, as. The Best Tax Software for 20PCMag Apr 1 20The Best Tax Software for 2020. The IRS is no longer processing refunds for 2014.

The Internal Revenue Code is the law that requires people to pay taxes and if you believe the folks who say itaposs only a legal requirement as assesse theyaposre wrong. These were due in April unless you got an extension. This date is dependent on the version of the software installed. US Citizens Living Abroad and Taxes - A Guide Bright. What is a Tax Office Reference Number?

You can import your filings from TurboTax or H R Block or import your TaxAct return from last year for no extra charge.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.